Apple Card represents Apple’s entry into the financial services market, offering a credit card designed specifically for iPhone users with seamless integration into the Apple ecosystem. This comprehensive guide walks you through the entire application process, from eligibility requirements to managing your new card (source: Apple Support).

What is Apple Card?

Apple Card is a credit card issued by Goldman Sachs Bank USA and managed through Apple’s Wallet app on iPhone. It offers:

- No annual fees or hidden charges

- Daily Cash rewards on purchases

- Enhanced privacy and security features

- Seamless Apple Pay integration

- Spending tracking and insights through the Wallet app

- Optional titanium physical card for non-Apple Pay merchants

Eligibility Requirements

Before applying, ensure you meet these basic requirements:

Essential Criteria

- Age: Must be 18+ years old (or age of majority in your state)

- Location: U.S. residents only

- Device: iPhone with iOS 12.4 or later

- Apple ID: Valid Apple ID signed into iCloud

- Two-Factor Authentication: Must be enabled on your Apple ID

Financial Requirements

- Credit History: Established credit history (though some applicants with limited history may qualify)

- Income: Sufficient income to support credit payments

- Legal Status: U.S. citizen or legal resident

- SSN: Valid Social Security Number

Apple Card is subject to credit approval and available only for qualifying applicants in the United States (source: Apple Card Application).

Step-by-Step Application Process

Method 1: Apply Through iPhone Wallet App

Step 1: Open Wallet App

- Locate the Wallet app on your iPhone home screen

- Tap to open the application

- Ensure you’re signed in to your Apple ID

Step 2: Initiate Application

- Tap the “+” button in the upper right corner

- Select “Apple Card” from the available options

- Tap “Continue” to begin the application process

Step 3: Review Terms and Conditions

- Read through Apple Card terms and conditions

- Review Goldman Sachs Bank USA credit agreement

- Understand privacy policy and data usage

- Tap “Agree” if you accept all terms

Step 4: Provide Personal Information Enter the following required information:

- Full legal name (as it appears on government ID)

- Date of birth

- Social Security Number

- Home address (physical address, not P.O. Box)

- Annual household income

- Employment status

Step 5: Submit Application

- Review all entered information for accuracy

- Tap “Submit Application”

- Wait for instant credit decision (usually within minutes)

Method 2: Apply Through Apple Card Website

For users who prefer web-based applications:

- Visit card.apple.com/apply/start

- Sign in with your Apple ID credentials

- Follow similar steps as the iPhone app process

- Complete application through web interface

Understanding the Approval Process

Instant Decision Process

Apple Card applications typically receive instant decisions through automated underwriting:

Approval Timeline:

- Instant approval: Most qualified applicants (within seconds to minutes)

- Under review: Some applications require additional verification (7-10 business days)

- Declined: Immediate notification with explanation

Credit Evaluation Criteria

Goldman Sachs evaluates applications based on:

| Factor | Weight | Considerations |

|---|---|---|

| Credit Score | High | Payment history, credit utilization |

| Income | High | Ability to repay credit obligations |

| Debt-to-Income Ratio | Medium | Existing debt obligations |

| Credit History Length | Medium | Duration of established credit |

| Recent Credit Inquiries | Low | Recent applications for new credit |

Key criteria used to determine whether your Apple Card application is approved include payment history, credit utilization, income verification, and overall creditworthiness (source: Apple Support).

What Happens After Approval

Digital Card Activation

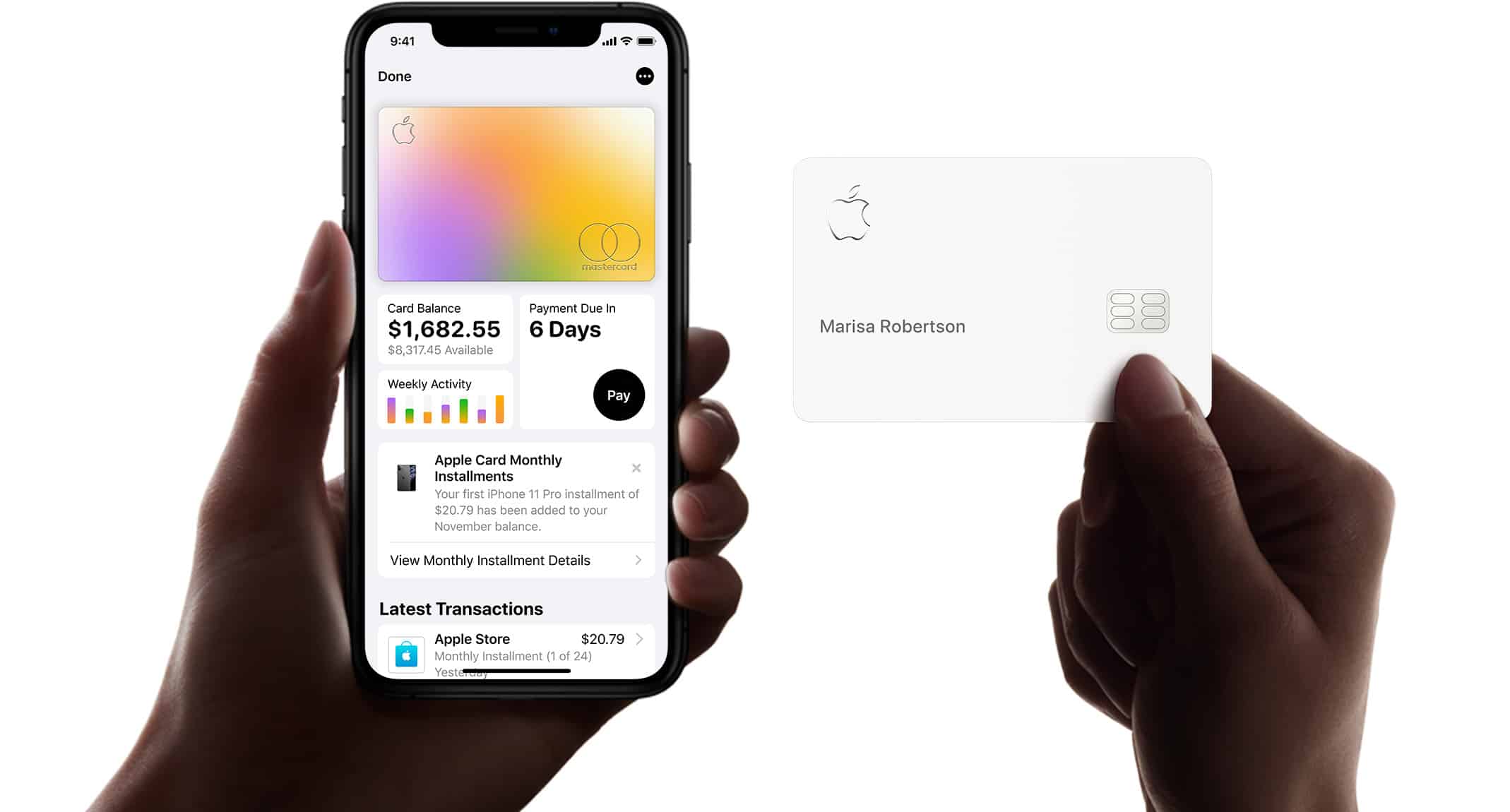

Once approved, you’ll receive your digital Apple Card immediately:

- Instant Access: Digital card appears in Wallet app immediately

- Apple Pay Ready: Can use for contactless payments right away

- Card Details: View card number, security code, and expiration date

- Spending Limits: Initial credit limit displayed in Wallet app

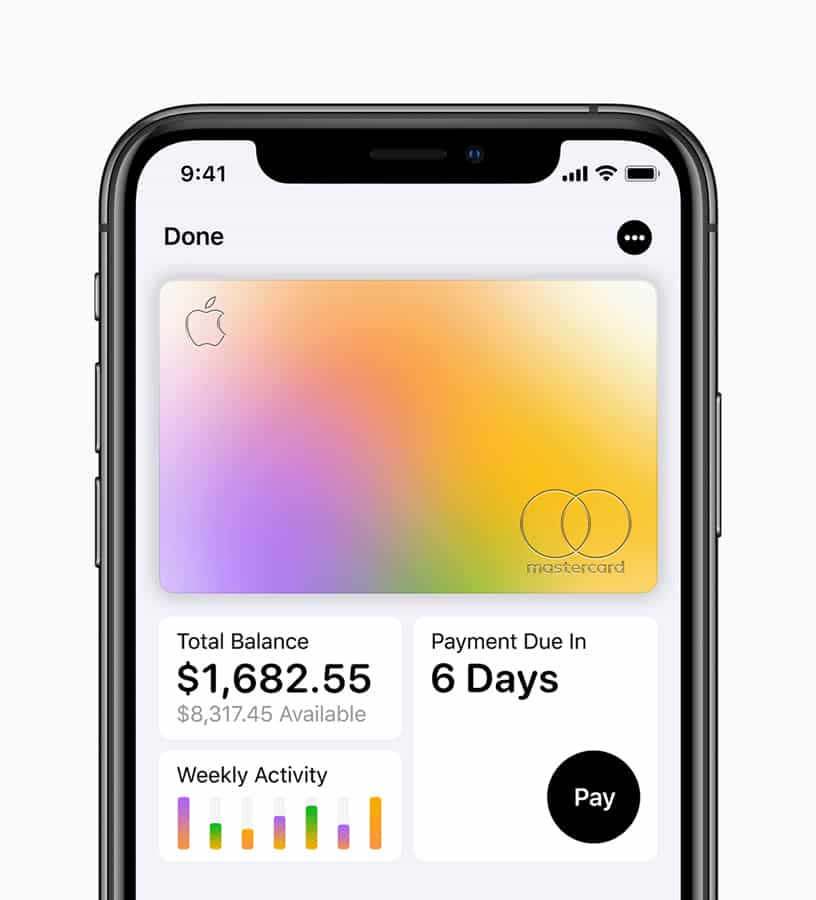

Physical Card Request (Optional)

You can request a titanium physical card for merchants that don’t accept Apple Pay:

- Open Wallet app and select Apple Card

- Tap “Request Titanium Apple Card”

- Confirm shipping address

- Physical card arrives in 7-10 business days

If Your Application is Declined

Understanding Declined Applications

Common reasons for Apple Card application denial:

- Insufficient credit history

- Low credit score

- High debt-to-income ratio

- Recent bankruptcy or foreclosure

- Incomplete or inaccurate application information

Path to Apple Card Program

For declined applicants, Apple offers the “Path to Apple Card” program:

Program Features:

- Personalized improvement steps based on your credit profile

- Educational resources about credit building

- Timeline guidance for reapplication eligibility

- Progress tracking through Goldman Sachs partnership

Learn about the Path to Apple Card program and see what’s involved to complete your personalized steps and reapply for Apple Card (source: Apple Support).

Steps to Improve Your Application

- Check credit report for errors or issues

- Pay down existing debt to improve credit utilization

- Wait for credit improvements to reflect on your report

- Increase income if possible

- Reapply after 30+ days following program guidance

Managing Your Apple Card

Daily Cash Rewards

Apple Card offers tiered rewards:

| Purchase Type | Daily Cash Rate | Examples |

|---|---|---|

| Apple Purchases | 3% | iPhone, iPad, Mac, App Store |

| Apple Pay Merchants | 2% | Contactless payments |

| Physical Card | 1% | Merchants without Apple Pay |

Monthly Statements and Payments

- Statement Generation: Monthly statements available in Wallet app

- Payment Options: Pay from bank account or debit card

- Payment Scheduling: Set up automatic payments or manual payments

- Interest Rates: Variable APR based on creditworthiness

Credit Management Tools

Apple Card provides built-in financial management features:

Spending Insights:

- Category tracking with color-coded spending

- Merchant identification with logos and locations

- Weekly and monthly summaries

- Export capabilities for personal finance apps

Payment Tools:

- Interest calculator showing payment scenarios

- Payment scheduling with flexible timing

- Early payment options to reduce interest charges

Tips for a Successful Application

Before Applying

- Check your credit score through free services

- Review credit reports for accuracy

- Pay down credit card balances to improve utilization

- Ensure stable income documentation

- Update Apple ID information for accuracy

During Application

- Provide accurate information – errors can cause delays

- Use legal name exactly as it appears on government ID

- Enter current address where you receive mail

- Report total household income if married

- Double-check Social Security Number for accuracy

After Application

- Set up automatic payments to avoid late fees

- Use Apple Pay frequently to maximize 2% rewards

- Monitor spending through Wallet app insights

- Pay balances in full to avoid interest charges

- Keep contact information updated

Troubleshooting Common Issues

Application Problems

| Issue | Solution |

|---|---|

| App crashes during application | Update iOS, restart iPhone, try again |

| Can’t verify identity | Ensure accurate SSN and personal information |

| Apple ID issues | Verify two-factor authentication is enabled |

| Income verification problems | Have recent pay stubs or tax returns ready |

Post-Approval Issues

- Digital card not appearing: Force-close and reopen Wallet app

- Physical card not received: Contact Goldman Sachs customer service

- Apple Pay not working: Verify device compatibility and settings

- Spending notifications missing: Check Wallet app notification settings

Customer Support and Resources

Getting Help

- Apple Support: General Apple Card questions and technical issues

- Goldman Sachs: Credit-related questions, payments, account management

- Phone Support: Available 24/7 for urgent issues

- Chat Support: Available through Apple Support app

Educational Resources

Apple provides comprehensive resources for credit education and financial literacy through the Path to Apple Card program and ongoing account management tools.

The Apple Card application process is designed to be simple and user-friendly, typically providing instant decisions for qualified applicants. By ensuring you meet eligibility requirements and providing accurate information, most users can successfully obtain their Apple Card and begin enjoying the benefits of Apple’s integrated financial services ecosystem.

Sources: Apple Support – How to apply for Apple Card, Apple Card Application, Apple Support – How your Apple Card application is evaluated, Apple Support – About Path to Apple Card

Key Takeaways

- Applying for an Apple Card is processed via the iPhone through the Wallet app.

- Apple Card offers a no-fees experience with daily cashback rewards on purchases.

- The Apple Card provides an additional physical titanium card and emphasizes advanced security and privacy features within the Wallet app.

Eligibility and Application Process

Applying for an Apple Card has been designed to be a straightforward process that can be completed quickly right from your iPhone. With this digital-first credit card, Apple has emphasized a seamless integration with the Wallet app, allowing for easy tracking of purchases, payments, and cashback rewards. Potential cardholders can check their credit limit offers without impacting their credit score, a feature that offers peace of mind for those closely monitoring their financial health. The Apple Card distinguishes itself by offering a no-fee experience and up to 3% Daily Cash back on purchases which can be spent or accrued as savings, aligning with consumers’ appreciation for simple and effective reward structures.

Once approved, users can order a physical titanium card for free, although the card is primarily designed for use through the iPhone for both applications and transactions. The titanium card acts as a status symbol while giving users a backup payment method. Managing the Apple Card is done entirely through the Wallet app, where users can see detailed transaction histories, pay their balance, and access support as needed. The integration also means high-end security features and privacy, leveraging the technology within iPhones to protect cardholder information.

When applying for an Apple Card, individuals must first ensure they meet specific requirements. Then, the application process can be conveniently completed through the iPhone’s Wallet app.

Check Eligibility Requirements

To be eligible for an Apple Card, applicants need to tick off several boxes. They must be U.S. citizens or lawful U.S. residents with a valid, physical U.S. address, which includes military addresses. The applicant must be at least 18 years old—19 in some states—and own a compatible iPhone with the latest iOS version. They also need an Apple ID logged in to iCloud and have two-factor authentication activated for security. Creditworthiness is assessed during the application, although a hard inquiry, which can affect the credit score, is only performed after the applicant accepts the credit limit and APR offer.

- Age Requirement: Must be at least 18 years old (19 in some states)

- Citizenship: Must be a U.S. citizen or a lawful U.S. resident

- Address: Must provide a valid U.S. residential or military address

- Apple ID: Must have an Apple ID signed in to iCloud

- Two-factor authentication: Must be turned on for the Apple ID

- iPhone: Must be compatible with the latest iOS

- Credit evaluation: An assessment is done during the application; hard inquiries occur post-acceptance of credit terms.

Application via Wallet App

Applying for an Apple Card is straightforward using the Wallet app on an iPhone. First, open the Wallet app and click the Add button. Choose Apple Card, then tap Continue. The process will prompt the applicant to fill out personal details, which could include name, date of birth, income, and the last four digits of the Social Security number. A form of photo ID may also be requested to confirm identity. Once the information is submitted, the application is reviewed, and an offer detailing the credit limit and APR is presented. Acceptance adds the Apple Card to the Wallet app, allowing immediate use.

- Open the Wallet app on your iPhone.

- Tap the Add button (+) and select Apple Card.

- Tap Continue and fill in the necessary personal information.

- Review the credit terms offered, if acceptable, confirm to proceed.

Using Your Apple Card

When you get an Apple Card, it becomes part of your Apple Wallet, ready for you to make purchases and manage your finances effectively. This section guides you through the key features of using your Apple Card.

Make Purchases

With your Apple Card, you can buy items in stores, online, and in apps. If you’re shopping in a physical store, look for symbols indicating that Apple Pay is accepted, then use your iPhone or Apple Watch to complete the transaction. For online and in-app purchases, choose Apple Pay at checkout and authenticate with Touch ID, Face ID, or your passcode.

Manage Balance and Payments

You can view your balance and make payments using the Wallet app. To keep on top of your finances, it helps to pay off your balance frequently. If you ever need to adjust your credit limit, contact Goldman Sachs Bank USA, Salt Lake City Branch, the issuer of Apple Card. They can also assist if you need a credit freeze or wish to dispute entries on your credit report.

Understand Daily Cash Rewards

Apple Card offers daily cash back on your purchases. You receive:

- 3% for purchases made directly with Apple, including the App Store, Apple Music, and monthly installments.

- 2% for purchases made using Apple Pay.

- 1% for purchases with the titanium Apple Card.

This cash is deposited into your account daily and can be used instantly.

Apple Card Family Features

With Apple Card Family, you can share your Apple Card with others, adding them as co-owners or participants. Co-owners share the credit limit and all take part in building credit history. Participants, usually over the age of 13, can use the shared Apple Card but cannot affect the credit limit or history. This helps teach financial responsibility while leveraging the benefits of the card.

Frequently Asked Questions

This section aims to clear up common questions about how to apply for an Apple Card, including eligibility, needed credit scores, application steps, income requirements, and necessary documents.

What are the eligibility requirements for obtaining an Apple Card?

She must be at least 18 years old, a U.S. citizen or lawful resident with a valid, government-issued ID. Also, she will need an iPhone that is compatible with the Wallet app.

What credit score range is typically necessary to be approved for an Apple Card?

A good to excellent credit score—often around 660 or above—improves the chance of approval for an Apple Card, but they may consider other factors like income.

What are the application steps for securing an Apple Card?

First, open the Wallet app on their iPhone and tap the add button. Next, select Apple Card and tap ‘Continue.’ She must fill out the application, agree to the terms, and accept the offered credit limit and APR.

How does one’s financial profile affect the likelihood of being approved for an Apple Card?

Credit score, income, existing debt, and spending habits can all influence approval. Each application is evaluated on an individual basis.

Are there any income requirements to qualify for an Apple Card?

They haven’t specified a minimum income requirement, but the application will ask for annual income information as it helps determine creditworthiness.

What documents do I need to provide during the Apple Card application process?

Generally, an application will require a driver’s license or state ID. Occasionally, additional proof of identity or income documents may be required.