Apple Pay is becoming a big deal for folks who like to keep things simple and secure when they’re paying for stuff. It lets you use your phone to pay, so you don’t have to dig around for your cards. A lot of big banks and even smaller ones are jumping on board with Apple Pay. This means you can probably use it with the cards you already have.

From the US to Australia, and many places in between, banks are making it easy for their customers to tap and go with Apple Pay. Whether you’re grabbing coffee, shopping online, or paying bills, seeing if your bank supports Apple Pay could make your life a bit easier. Let’s take a closer look at which banks are in on this and what it means for you.

Banks That Support Apple Pay

| Region | Example Banks |

|---|---|

| North America (Canada, United States, Latin America) | Bank of America, Chase, Citibank, Wells Fargo, Scotiabank, Bancolombia, Banamex |

| Europe | Barclays, Lloyds Bank, HSBC, BNP Paribas, ING, Deutsche Bank, Santander |

| Asia Pacific | ANZ Bank, Commonwealth Bank of Australia, Bank of China, Industrial and Commercial Bank of China (ICBC), Westpac, DBS Bank, OCBC Bank |

| Middle East | Emirates NBD, Mashreq Bank, Saudi National Bank, Qatar National Bank |

| Africa | Standard Bank, First National Bank, Absa Bank |

Additional Information:

- Some banks may only support certain types of cards (e.g., credit cards, debit cards, prepaid cards).

- Not all cards from a participating bank may be supported by Apple Pay.

- You can check if your bank supports Apple Pay by visiting their website or contacting them directly.

Key Takeaways

- Wide Bank Support: Apple Pay is widely accepted by major banks around the globe, including the U.S., Europe, Asia, and Australia, making it a versatile payment option for international users.

- Ease of Setup: Setting up Apple Pay is straightforward across various Apple devices, requiring only a few steps to add debit or credit cards to the Wallet app for seamless shopping.

- Enhanced Security: Apple Pay employs a special transaction code and does not store card numbers on devices or Apple servers, offering a higher level of payment security compared to traditional methods.

- Convenience and Benefits: Not only does Apple Pay provide a quick and easy payment method at stores, apps, and online, but users also retain all rewards and benefits offered by their bank’s debit or credit cards.

- Growing Acceptance: With its increasing popularity, more retail stores, apps, and websites are accepting Apple Pay, signaling a shift towards more secure and convenient payment methods in daily transactions.

- Accessibility: Apple Pay’s support from both large banks and smaller institutions ensures that a wide range of customers can enjoy its benefits, making digital payments accessible to a broader audience.

What is Apple Pay?

Apple Pay is a digital wallet and mobile payment service by Apple Inc. It lets users make payments using an iPhone, Apple Watch, iPad, or Mac. Instead of using physical cards or cash, people can pay with their devices. It’s easy and works with the touch of a finger.

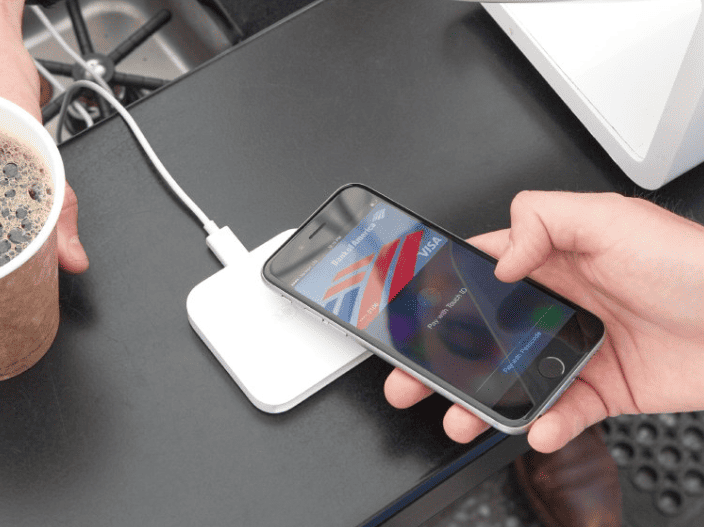

Setting up Apple Pay is simple. Most Apple devices come with it ready to use. Users just add their debit or credit card info to the Wallet app. Now, they’re set to shop in stores, in apps, and online without pulling out their cards. It’s all about tapping the device on a payment reader or using it online.

Stores, apps, and websites that accept Apple Pay show a special logo at checkout. This logo means “we accept Apple Pay here.” To make a payment, look for this symbol. Not all places take Apple Pay yet. But many do, including big and small stores, apps, and websites.

The service uses near field communication (NFC) for in-store payments. This tech lets devices talk to each other when they’re close. For online or in-app purchases, Apple Pay works without NFC. Instead, it uses the internet for the transaction.

Security is big with Apple Pay. When adding a card, it’s not stored on the device or Apple’s servers. A unique code is created for each transaction. This means safer payments because the card number isn’t shared with stores or Apple.

Many banks support Apple Pay. This includes big ones and smaller local banks. They understand the need for easy, secure payment options. Checking if your bank supports Apple Pay is a good idea. It could make shopping smoother and safer.

Benefits of using Apple Pay

Apple Pay brings a lot of advantages to the table when it comes to easy and secure payments. First, it’s super simple to set up. If you’ve got an iPhone, iPad, Apple Watch, or MacBook, you can add your debit or credit card to Apple Pay in a few steps. Once your card is added, you’re ready to make purchases without needing your physical card.

One big plus is the security Apple Pay offers. Every time you use it, Apple Pay uses a special code for the transaction. This means your card number isn’t shared with the merchant or even stored on your device. If someone steals your phone, they won’t get access to your card details. It’s a safer way to pay.

Another benefit is the speed and convenience. Imagine you’re in a store, ready to pay. Instead of digging through your wallet for your card, you just use your phone or watch. Tap it on the reader, and you’re done. It’s fast and easy. This works not just in stores, but also in apps and on websites.

Also, don’t worry about losing your rewards and benefits that come with your cards. When you use Apple Pay, you still get all the rewards, points, or cash back that your card offers. It’s like using your physical card, but better.

Apple Pay is becoming more popular, and many banks support it. This means more and more people can use it for their daily shopping. Whether it’s a big bank or a local one, chances are they’re making it easy to use Apple Pay.

For anyone who’s been there, trapped without their wallet, or wanting a safer way to pay, Apple Pay is a solid choice. It’s built to be easy, safe, and rewarding. With each passing day, it’s becoming clearer that Apple Pay is not just a convenience but a necessity for modern shopping.

Major banks supporting Apple Pay

When it comes to modern-day shopping, Apple Pay is a game changer. It’s easy, secure, and fast. But what banks are on board with this tech? Let’s dive in.

In the U.S., big names like Bank of America, Chase, Wells Fargo, and Citi were quick to adopt Apple Pay. They saw the benefits from day one, mainly its top-notch security and the straightforward setup process. These banks support Apple Pay because they know it’s a safe way to shop and keep their customers happy.

Besides the giants, many smaller banks and financial institutions have also jumped on the Apple Pay train. For example, Fifth Third Bank, First National Bank, and USAA are in the mix. They offer Apple Pay to give their clients an even better banking experience.

But it’s not just an American thing. Across the pond, Europe’s banking scene has embraced Apple Pay too. Barclays in the UK, BNP Paribas in France, and Deutsche Bank in Germany let their customers use Apple Pay. It shows that this payment method isn’t limited to one area – it’s worldwide.

Asia and Australia are in on it as well. Banks like DBS, OCBC, and UOB in Singapore have made Apple Pay an option for their users. In Japan, heavyweights like MUFG and Rakuten make shopping with a tap possible. Down under, ANZ, Westpac, and Commonwealth Bank support Apple Pay, proving it’s a hit in Australia too.

Apple Pay works with lots of credit and debit cards from these banks. This means people can keep getting rewards and benefits from their cards, just in a more secure and convenient way. Plus, Apple is always working to add more banks to the list. So, if someone’s bank isn’t supported yet, there’s a good chance it might be soon.

How to set up Apple Pay with your bank

Setting up Apple Pay for making purchases is straightforward. Once you know if your bank supports it, adding your card takes only a few minutes. Users should follow a simple process, depending on their device.

For iPhone users, it begins with opening the Wallet app. Tap the “+” icon, then select “Debit or Credit Card.” From here, you can add a new card or pick one used before. After inputting the card details, follow the screen prompts to finalize the setup. It might require verification from the bank or card issuer, ensuring that everything’s secure.

Apple Watch owners will use their paired iPhone. They should open the Apple Watch app, tap on the “My Watch” tab, and choose “Wallet & Apple Pay.” Once there, tapping “Add Card” starts the card addition process. Similar to the iPhone, users will follow on-screen instructions which may include bank verification steps.

For those with an iPad, the process also feels familiar. Go into Settings, select “Wallet & Apple Pay,” and then “Add Card.” The steps from here mirror those on the iPhone, focusing on entering card information and completing any required bank verification.

Mac users are not left out. If the Mac has a Touch ID, users can go to System Preferences, click on “Wallet & Apple Pay,” and then “Add Card.” The addition and verification process is very similar to that of the iPad and iPhone, designed to keep user information safe.

Adding a bank card to Apple Pay is not just about ease; it’s about making transactions faster and more secure. With each device, Apple ensures users go through a process that both confirms their identity and links their bank securely. As banks continue to work with Apple Pay, customers enjoy the convenience of tap-and-go payments across a growing number of stores and services.

Conclusion

The integration of Apple Pay with major banks around the globe marks a significant leap towards simplifying digital transactions. By following the outlined steps to set up Apple Pay on various devices, users can enjoy the convenience and security of tap-and-go payments. As the collaboration between banks and Apple Pay continues to expand, the future of digital payments looks promising. With just a few taps, shopping and managing finances have never been easier, highlighting the importance of adopting innovative payment solutions in today’s fast-paced world.

Frequently Asked Questions

Can I use Apple Pay to withdraw money at an ATM?

Yes, you can withdraw money at ATMs that support Apple Pay. Look for ATMs with the contactless symbol and select your bank card in Apple Pay to use it.

Can you get cash back with Apple Pay without a card?

You need to have a card linked to Apple Pay. Without this, no cash back. You can’t get cash back at ATMs. But, you can withdraw cash at some ATMs.

Can I add my driver’s license to my Apple Wallet?

Yes, you can add your driver’s license to Apple Wallet. Open the Wallet app, tap the Add button, choose Driver’s License or State ID, select your state, and decide if you want it added to your iPhone, Apple Watch, or both.

Why use Apple Pay instead of a credit card?

Apple Pay offers a more secure and private way to pay than physical credit, debit, or prepaid cards. It uses your device’s built-in security features to protect transactions, making it a safer and more convenient payment method.

How do I know if a place takes Apple Pay?

To determine if a business accepts Apple Pay, look for Apple Pay and NFC/tap and pay decals in store windows and at points of sale. This indicates that they support contactless payments through Apple Pay.