When buying electronics, appliances, or furniture, the offer of an Allstate Protection Plan often comes up. The question is whether paying extra for this coverage makes sense. An Allstate Protection Plan can be worth it for high-cost items you plan to keep for years, but it may not add much value for cheaper products or those already covered by strong manufacturer warranties.

These plans cover mechanical failures, defects, and in many cases, accidental damage like drops or spills. Claims are usually handled online, and Allstate works with major retailers and repair shops, which makes the process more convenient than going through some manufacturers. At the same time, exclusions, deductibles, or payout limits can leave some people frustrated if the plan does not meet their expectations.

The decision comes down to comparing the cost of coverage with the risk of paying for repairs out of pocket. For some, the peace of mind outweighs the price. For others, setting aside money for possible repairs works just as well.

What Are Allstate Protection Plans?

Allstate Protection Plans are extended warranties and insurance-like coverage for electronics, appliances, furniture, and other items. They are often sold through retailers like Walmart, Amazon, Costco, and directly via Allstate.

✅ What They Cover

Coverage depends on the plan and product type, but generally includes:

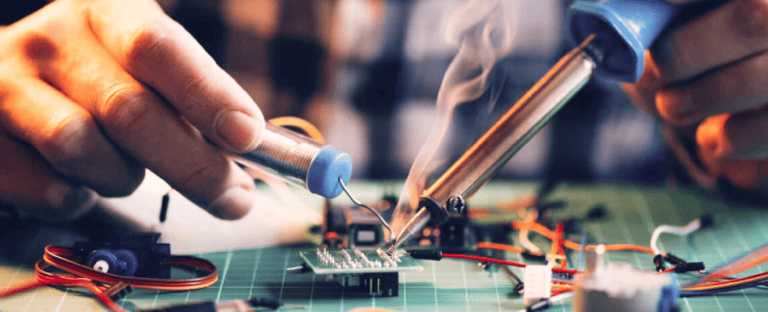

1. Electronics (phones, laptops, tablets, consoles, headphones, etc.)

- Mechanical/electrical failures after the manufacturer’s warranty ends

- Screen cracks (for phones & tablets)

- Battery failures

- Power supply issues

2. Appliances (refrigerators, washers, ovens, etc.)

- Mechanical failures

- Electrical failures

- Power surges

- Sometimes food spoilage reimbursement (for refrigerators)

3. Furniture

- Stains (food, drink, pet accidents)

- Rips, tears, and burns

- Structural failure (broken frames, recliner mechanisms, etc.)

4. Other items

- Jewelry, watches, fitness equipment, and more (coverage varies by retailer).

*(sources: RepairSpotter, ConsumerAffairs, MoneyCrashers)

❌ What They Don’t Cover

- Loss or theft (unlike phone insurance)

- Intentional damage or misuse

- Cosmetic damage (scratches, dents) that doesn’t affect function

- Pre-existing issues before purchase

- Consumables (like light bulbs, ink cartridges, etc.)

💰 How Much Do They Cost?

- Small electronics: ~$5–$20 for 2–3 years of coverage

- Larger appliances: $50–$150 depending on price of item

- Furniture: Often ~$50–$100 for 3–5 years

The cost is usually 10–20% of the product’s price.

📝 How Claims Work

- File a claim online or by phone.

- Allstate may:

- Send a replacement item,

- Pay you the item’s current value, or

- Reimburse repair costs.

- Many users report cash payouts are sometimes less than the original purchase price (source: Reddit).

👍 Pros

- Covers accidents (like cracked screens, spills, stains) that manufacturer warranties don’t.

- Affordable for high-risk items (phones, laptops, gaming consoles).

- Easy online claims process.

- Transferable if you sell the item.

👎 Cons

- Payouts may be less than you paid for the item.

- Some customers report slow or frustrating claims service.

- For cheap items, the plan can cost almost as much as replacing the item.

- Manufacturer warranties already cover the first 1–2 years of defects.

🧐 Are They Worth It?

- Worth it if:

- You’re buying expensive electronics (phones, laptops, TVs, consoles).

- You want accident protection (drops, spills, stains).

- You plan to keep the item for 3+ years.

- Not worth it if:

- The item is cheap or easily replaceable.

- You already have credit card extended warranty benefits (many premium cards double manufacturer warranties).

- You’re comfortable taking the risk and saving money instead.

✅ Bottom Line:

Allstate Protection Plans can be a smart buy for high-value, accident-prone items like phones, laptops, and appliances. For low-cost items, you’re usually better off skipping the plan and saving the money.

Key Takeaways

- Allstate Protection Plans cover a wide range of products and issues

- Claims are often simple but may include limits or exclusions

- Value depends on the item’s cost, warranty, and repair risk

Frequently Asked Questions

Allstate protection plans cover a wide range of products, but the details vary by item type, retailer, and purchase channel. Costs, claim limits, and deductibles can differ, and customer feedback often highlights both convenience and frustrations.

What benefits do Allstate protection plans offer for electronics purchases?

Electronics like smartphones, laptops, and gaming devices can be covered for mechanical failures and accidental damage. Plans often include 24/7 online claims and may have no deductible for some categories, though phone repairs usually carry a deductible around $149. Coverage length ranges from monthly to multi-year terms depending on the device.

How do Allstate protection plans for furniture compare to other insurance options?

Furniture plans usually last three to five years and cost between $49.99 and $399.99. They cover stains, rips, and certain types of damage but exclude outdoor furniture. Claims must be filed within 30 days of the incident, which is stricter than many other furniture insurance options.

What is the coverage extent of Allstate protection plans for items bought on eBay?

Allstate partners with eBay to provide protection plans for eligible purchases. Coverage applies to product defects and certain types of accidental damage. The cost and length of coverage depend on the item category, and claims are filed through Allstate’s SquareTrade service.

Are there any significant differences between Allstate protection plans offered through different retailers?

Yes. While the core coverage is similar, retailers often set different prices and terms. Some plans include accident protection, while others cover only mechanical failures. Retailer-specific restrictions, such as claim filing deadlines, can also affect the usefulness of the plan.

How does the cost of Allstate protection plans at Costco compare to direct purchase from Allstate?

Plans sold through Costco often appear cheaper than buying directly but may include narrower coverage or longer repair times. Some users report delays in service when filing through Costco. Direct purchase from Allstate can provide broader options, though the price may be higher.

What has been the general consumer feedback on Allstate protection plans for Wayfair purchases?

Wayfair customers report mixed experiences. Some value the quick approval process and broad coverage for furniture and home items. Others note delays in repair or replacement and restrictions on what damage qualifies. Feedback suggests the service works well for certain claims but not consistently across all cases.